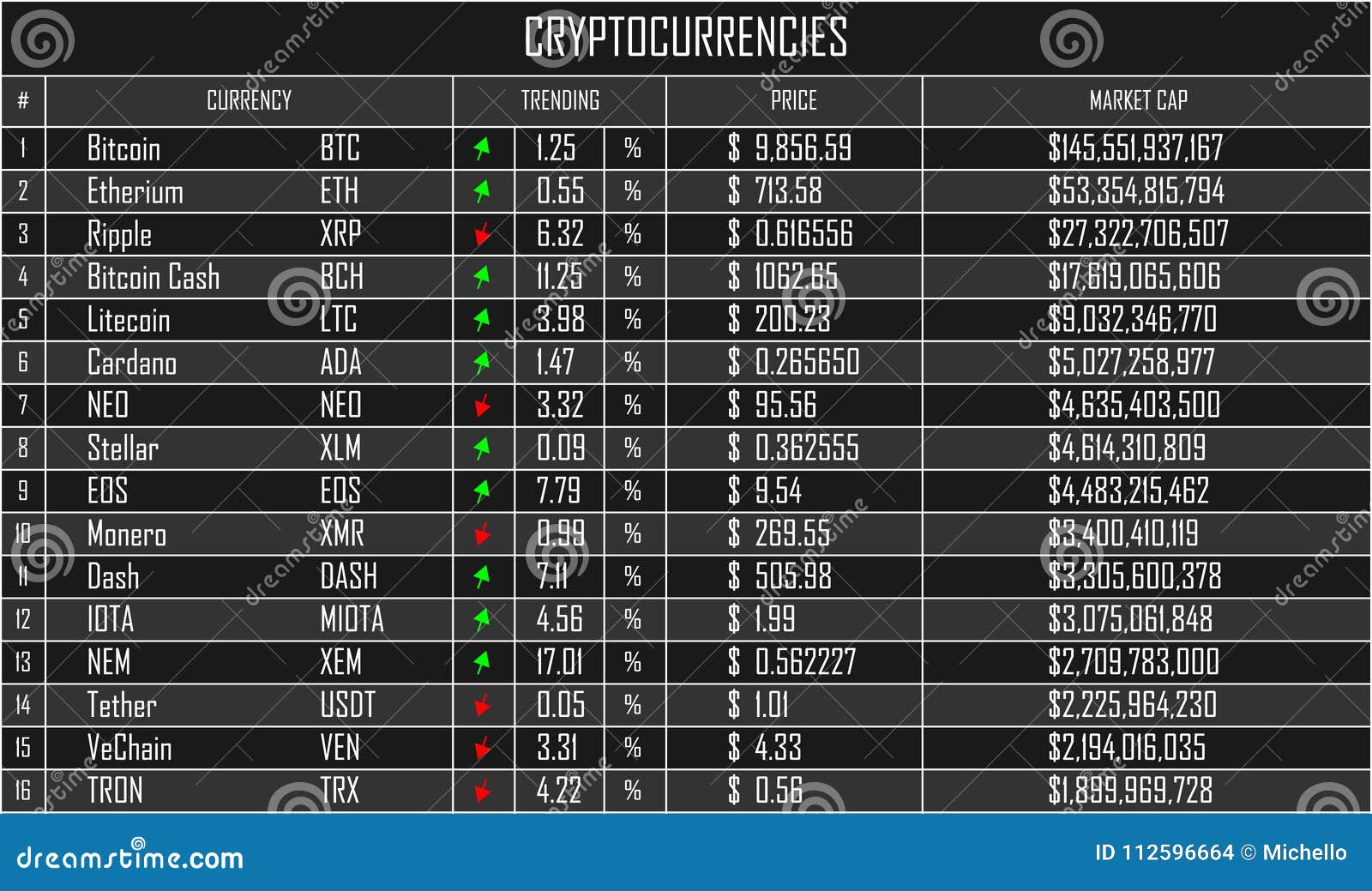

Value of all cryptocurrencies

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract https://xiaomidroneturkiye.com/slot-provider/aristocrat/. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.

What are all the cryptocurrencies

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

Are all cryptocurrencies mined

Though they are, by name, opposites, the purpose of mined and non-mined cryptocurrency is the same: validation. Ultimately, each transaction processed over a blockchain network needs to be verified by someone to ensure that the same virtual token wasn’t spent twice. In effect, it describes the process of proofing a transaction to make sure it’s true. A group of transactions is considered to be part of a “block,” and when a block of transactions has been validated, it joins the previously validated blocks to create a chain of true transactions, or a “blockchain.”

Cryptocurrency mining describes a process where an individual, group of individuals, or a business, will use high-powered computers to solve complex mathematical equations in an effort to validate a block of transactions. These mathematical equations are part of the encryption that protects transactions from cybercriminals, as well as other people who shouldn’t have access to sender and receiver data.

Last but not least, significant changes may happen at the protocol level. For example, the halving of Bitcoin can affect mining profitability as it cuts the reward for mining a block in half. In other cases, the process of mining can be replaced by other validation methods. For example, Ethereum switched completely from the PoW to the Proof of Stake (PoS) consensus mechanism in September 2022, which made mining unnecessary.

At this point, the candidate block becomes a confirmed block, and all miners move on to mine the next block. Miners who couldn’t find a valid hash on time discard their candidate block as a new mining race starts.